Tomorrow at 8:30 am ET we will get the long-awaited Apr CPI. Many are anxious to see whether CPI manages to reverse its trend from prior months.

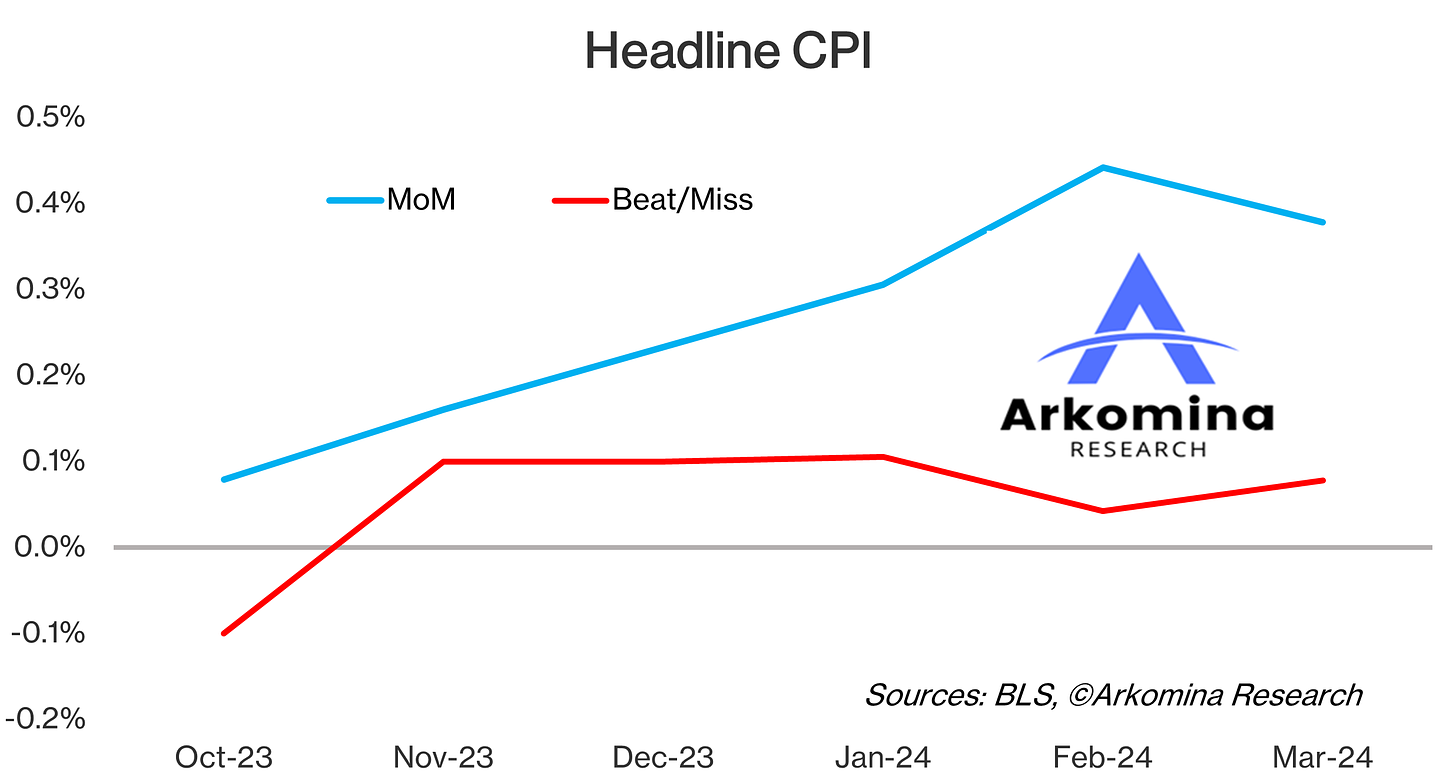

Namely, in Q1 2024 CPI figures were hotter than expected. This comes after quite tame reads in Q4 2023. On average, headline CPI in Q1 2024 printed +0.2 pp above their Q4 2023 MoM figures.

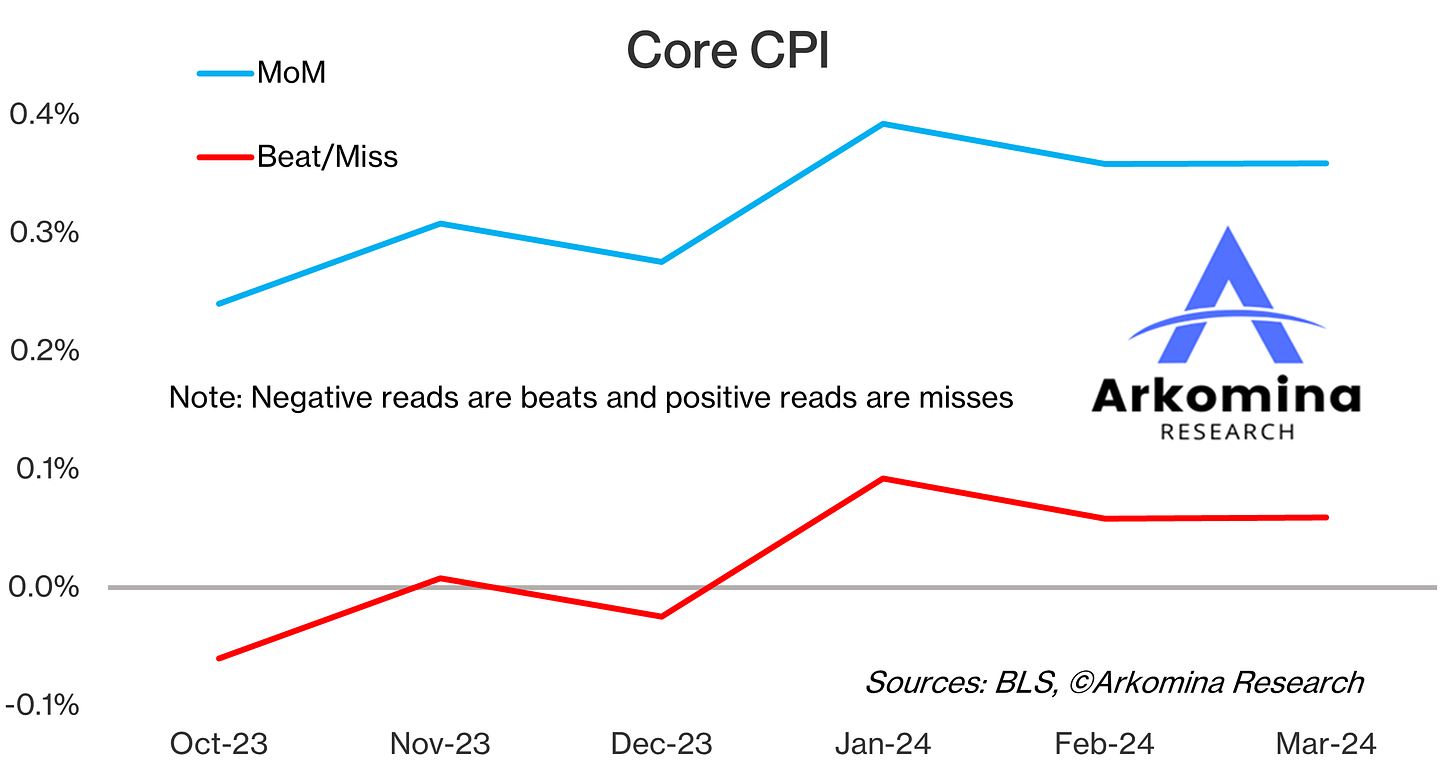

On average, core CPI in Q1 2024 printed +0.1 pp above Q4 MoM figures.

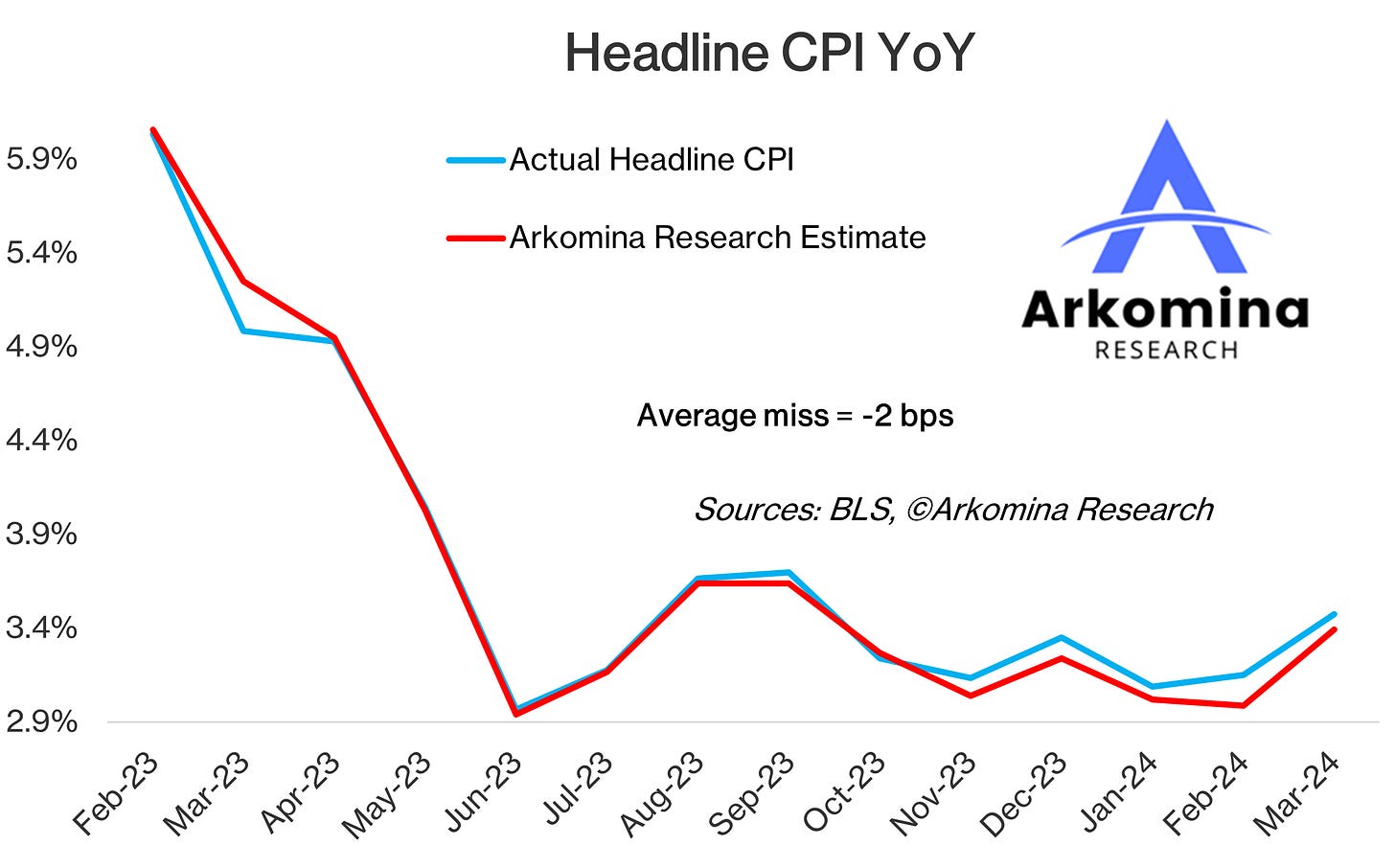

My average error for estimating headline CPI remains extremely low at -2 bps.

My average error for estimating core CPI also remains quite low at -4 bps. For public links to my prior month estimates go to ArkominaResearch.com.

Powell slammed the door on hikes at the Fed meeting 2 weeks ago convinced inflation reads will improve this year. However, if inflation reads keep printing higher than expected, he could possibly bring hikes back on the table.

After hotter prints in the first 3 months of this year and the latest hotter-than-expected PPI everyone is impatient to learn if CPI continued to print higher or it cooled down in Apr.

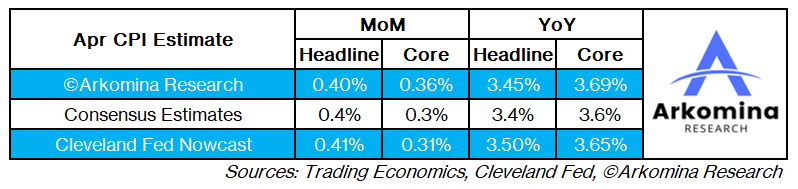

My CPI estimates are…

…in line with consensus for headline CPI MoM and 0.1 pp higher than consensus for headline YoY, as well as both MoM and YoY for core CPI.

My estimates are also roughly in line with Cleveland Fed Nowcast for headline CPI but 0.1 pp higher than Cleveland Fed Nowcast for core CPI.

If we get another +0.4% MoM for headline and core CPI, this may still not be too much of a problem for the Fed because core CPI will likely make the largest YoY progress since Oct 2023 and going to the lowest level since Apr 2021.

However, continued +0.4% MoM prints for headline and core would put an incredible amount of weight on May CPI as it goes out on the 2nd day of Jun Fed meeting and could be crucial to whether the Fed changes their stance on inflation.

To get an early insight into May CPI read, you can read Marko’s CPI Report which contains:

forward looking inflation indicators

detailed Apr CPI estimate

forward trajectory for headline and core CPI this year

a surprising fact that could change your view on the Fed and inflation

To get Marko’s CPI Report, make sure to subscribe to Arkomina Research Pro Investor.

As a subscriber to this article you get a Special Offer of up to -60% off on premium research.

For more information about Arkomina Research and how to subscribe using Special Offer click this link here.

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as a legal, tax, investment, financial or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral or special damages or losses of any kind.

Thank you. You are the best analyst.

Grateful 🙏