Wednesday at 8:30 am ET we will get the Jan CPI. CPI is one of the 2 most important macro prints each month and one could argue that this month's CPI is perhaps even the most important macro print as the focus shifted to tariffs and their potential impact on inflation. Even the market is now focused more on the CPI than in some prior months. If CPI comes in favorable, hopes of the Fed’s pause being over soon could go up. On the other hand, if CPI comes in hotter, the Fed could extend its pause.

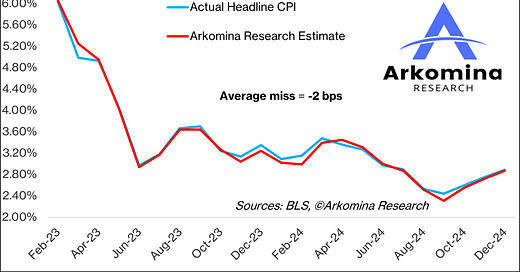

My average error for estimating headline CPI (based on the last 23 CPI estimates from Feb 2023 - Dec 2024) is extremely low at -2 bps (-0.02 pp).

More importantly, my headline CPI estimates have been closer to the actual number than the average Wall Street estimates by 2 bps on average, 13 times in the last 19 months or 68% of the time.

My average error for estimating core CPI (based on the last 23 core CPI estimates from Feb 2023 - Dec 2024) is also extremely low at -2 bps (-0.02 pp).

My core CPI estimates have been closer to the actual number than the average Wall Street estimates by 1 bps on average, 13 times in the last 19 months or 68% of the time.

For public links to my prior month's CPI estimates, go to ArkominaResearch.com.

In Q4 2024, headline CPI went up from +2.44% YoY in Sep to +2.89% YoY in Dec. Nov was up +0.31% MoM, which was the first month in 7 that didn’t have +0.2% MoM or lower reads. Then, in Dec headline went up +0.39% MoM, which was the first +0.4% MoM read in 10 months. Contrary to expectations, core CPI managed to improve in Q4 2024 from +3.31% YoY in Sep to +3.24% YoY in Dec. Core CPI went up +0.23% MoM in Dec, which was the first sub-0.3% read in 5 months. The biggest question on everyone’s mind is - what happened with CPI ahead of the tariffs? Did headline and core CPI manage to improve? Or just one of them improved? Or both of them failed to make progress in Jan?

My Jan CPI estimates are…

The same as the current consensus estimates. When I first published my estimates in Marko’s CPI Report several days ago, only MoM consensus estimates were known. We have in the meantime gotten the YoY estimates as well, which turned out to be the same as mine.

Headline CPI

+0.3% MoM

+2.9% YoY

Core CPI

+0.3% MoM

+3.1% YoY

My unrounded estimates:

I am expecting headline CPI to make no progress and core CPI to go down by -0.1 pp, which would be the best one-month progress since Jun and the lowest core CPI read since Apr 2021.

The market currently doesn’t see the Fed cutting in Mar. If we get these numbers, expectations may not change materially, at least not yet. For Mar to be a live meeting we would need to see progress in Jan, as well as cooler CPI and the unemployment rate picking up in Feb.

If you’re interested in learning my longer-term CPI estimates (until the end of 2025), consider subscribing to Marko’s CPI Report which goes out each month before CPI and, among other things, contains analyses of:

Forward-looking inflation indicators

Detailed Jan CPI estimate

Headline and core CPI trajectory until the end of Q4 2025

Preliminary Feb CPI estimate

To get Marko’s CPI Report, make sure to subscribe to Arkomina Research Pro Investor at this link: ArkominaResearch.com/Subscriptions/

By subscribing to Pro Investor you also get:

Marko’s Fed report that goes out before each Fed meeting and, among other things, contains a detailed analysis of the economy and what type of landing we are in, an analysis of monetary policy lags, what will the Fed likely do in 2025, headline and core PCE inflation trajectory and the unemployment rate trajectory

Marko’s Brain Daily which goes out each trading day contains analyses of all relevant macro indicators and events (such as Fed speeches and Fed meetings) from the prior day, my estimates for all important macro indicators coming out that day, and how the market may react to each scenario, as well as my view of the equity and bond market short-term direction, earnings analyses and much more

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as legal, tax, investment, financial, or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral, or special damages or losses of any kind.

Thank you Marko. Your estimates have been extremely valuable