Wednesday we will get Mar CPI data that could be crucial for the Fed’s policy this year.

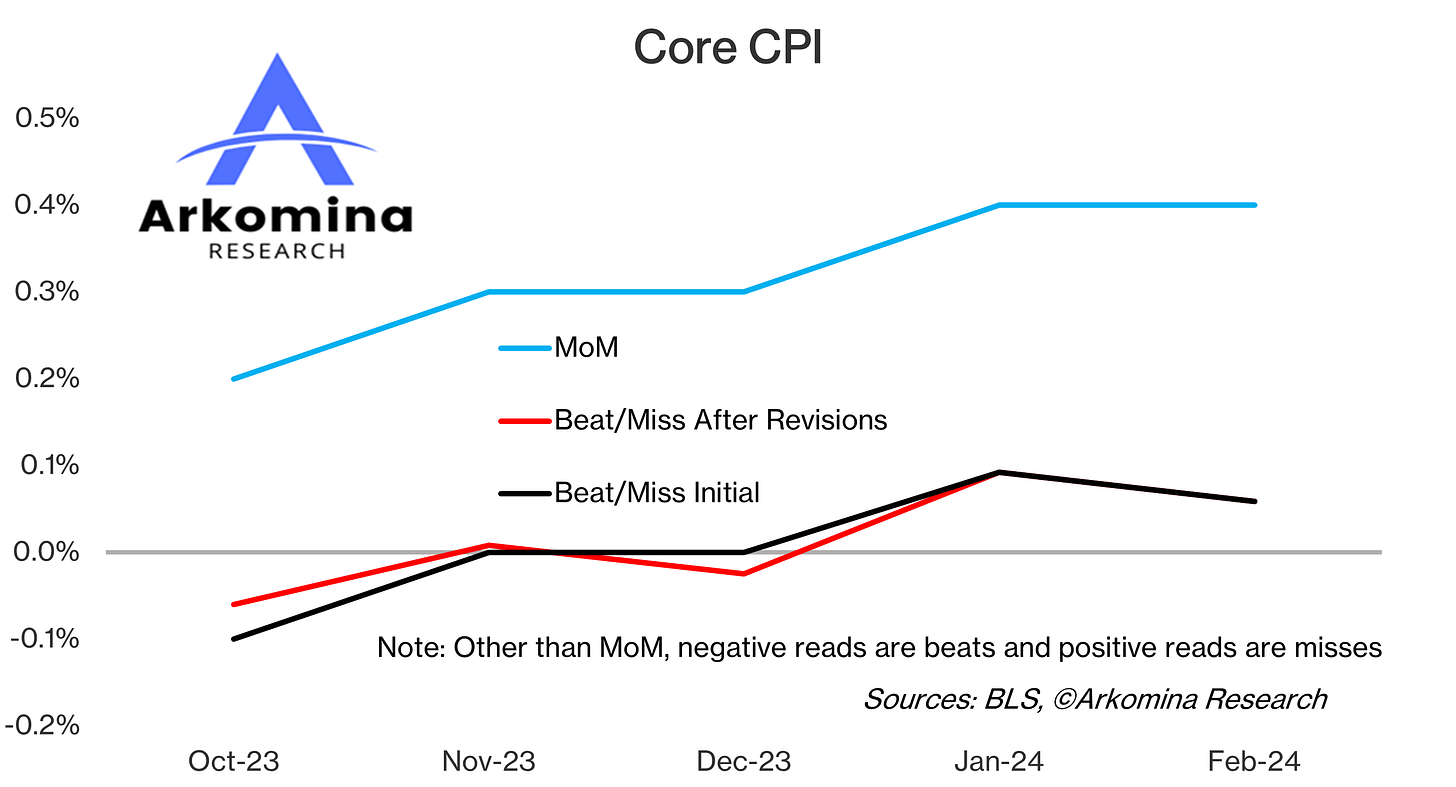

For the past 2 months CPI has surprised on the upside after being quite tame in Q4 2024. Besides mostly missing expectations in 2024, both headline and core CPI have been in an upward trend on MoM basis since Oct 2023.

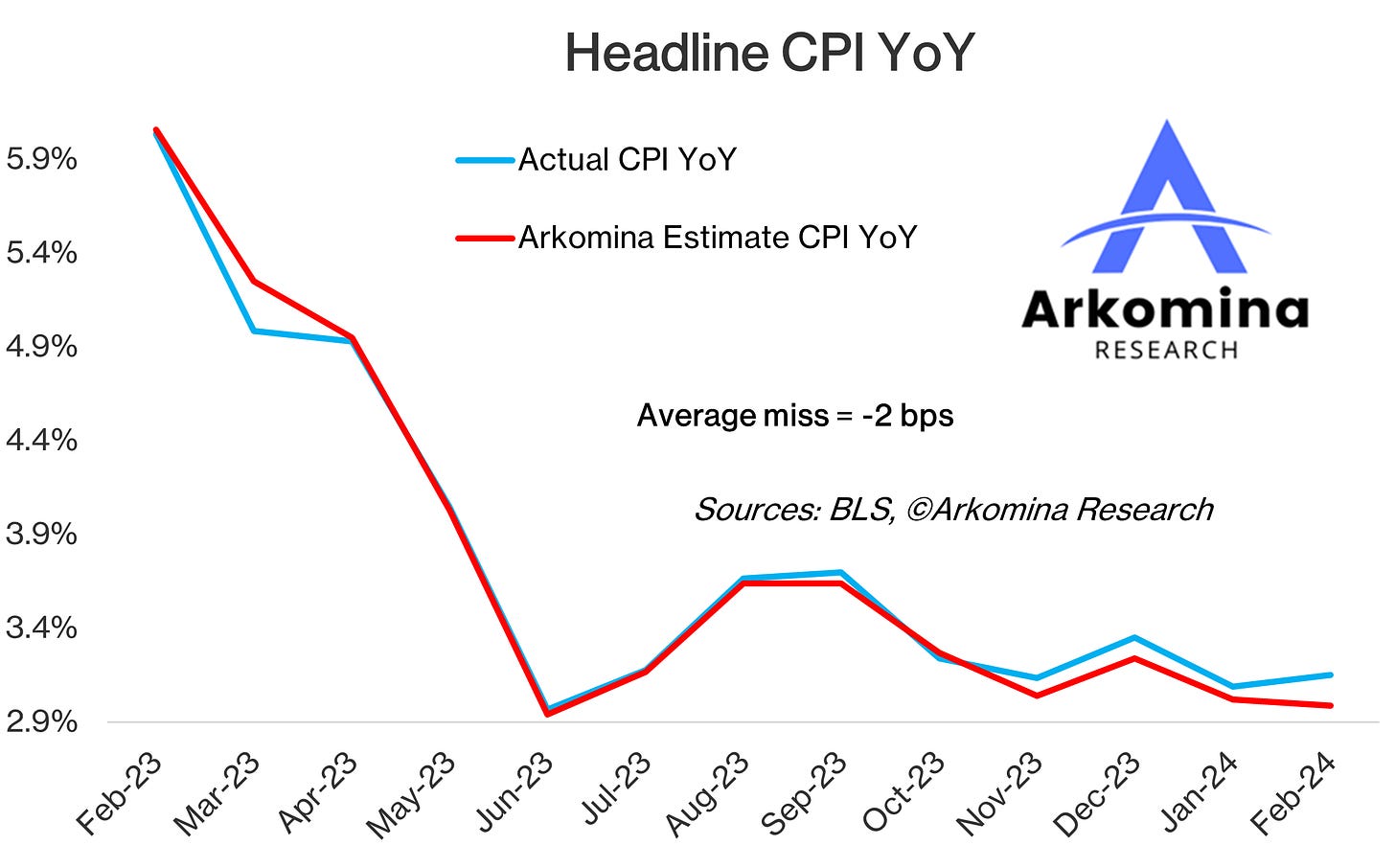

Feb 2024 CPI was my biggest miss to date. Even so, my average error for estimating CPI remains extremely low at -2 bps for headline CPI.

My average error for core CPI is at -4 bps. For public links to my prior month estimates go to Arkominaresearch.com.

Headline and core CPI missing expectations in 2024 have worried some investors and Fed officials to a point that some of them started talking about a possibility of no cuts in 2024 (Kashkari) or even mentioning possible hikes from here (Bowman).

Prior to Jan CPI reads the market expected as much as 7 rate cuts in 2024. Back then the cuts were expected to start in Mar with the Fed then cutting at every subsequent meeting. In late Jan Powell dismissed a possibility of Mar cuts and after higher-than-expected Jan CPI read, May got into question as well. When we got another higher-than-expected CPI in Feb, May cut was taken completely off the table and expectations shifted to Jun. Now Jun meeting is at 50:50 and if we get another miss for the CPI in Mar, the Fed may not cut rates at all this summer.

So, the big question is will we see another disappointing CPI or the data will be more favorable after 2 bad months?

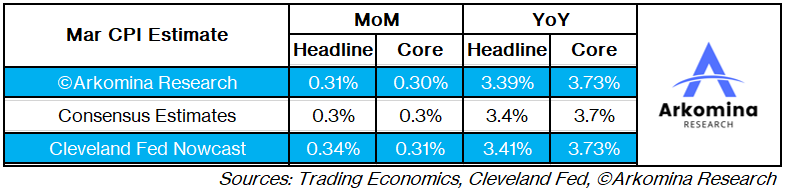

My Mar CPI estimates are…

… in line with consensus and Cleveland Fed Nowcast.

If we get a 0.2% MoM or lower for the core CPI, June cut will probably remain on the table. If we get an in line print, Jun cut could theoretically still be on the table if Mar PCE ends up more convenient than the CPI. I will publish my Mar PCE estimates here after we get the actual CPI and PPI data this week.

If you’re interested in more detailed CPI analysis that contains:

forward looking indicators,

detailed CPI forecast for Feb and

core and headline CPI trajectory in 2024,

consider subscribing to Marko’s CPI Report which is part of premium Arkomina Research.

As a subscriber to this article you get a Special Offer of up to -60% off on premium research.

For more information about Arkomina Research and how to subscribe using Special Offer click this link here.

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as a legal, tax, investment, financial or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral or special damages or losses of any kind.