Tomorrow at 8:30 am ET we will get the long-awaited May CPI. Normally, CPI is the most important print in any month but this month it will be even more important because it goes out on the 2nd day of the Fed meeting, meaning it could determine the tone of the Fed meeting.

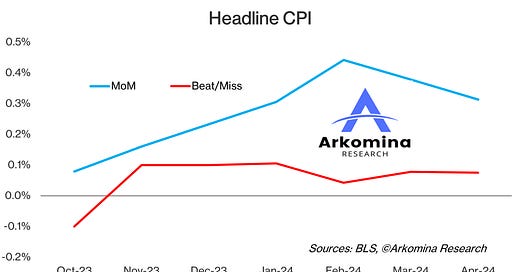

So far in 2024 CPI hasn’t been all that great. In Q1 CPI was hotter than expected and in Apr it came in line with expectations. Q1 this year came after quite tame reads in Q4 2023. On average, headline CPI in the first 4 months of 2024 printed +0.2 pp above its Q4 2024 MoM figures.

On average, core CPI in the first 4 months of 2024 printed +0.1 pp above Q4 MoM figures.

My average error for estimating headline CPI remains extremely low at -2 bps.

My average error for estimating core CPI is also quite low at -3 bps.

For public links to my prior month CPI estimates go to ArkominaResearch.com.

The market is currently divided between expecting a first cut in Sep and Nov. A hotter CPI print could push expectations further out, while a cooler print could even bring them forward so everyone is impatient to learn what happened with CPI in May.

My CPI estimates are…

Headline CPI

+0.1% MoM (in line with both consensus and Cleveland Fed) and +3.3% YoY (-0.1 lower than both consensus and Cleveland Fed)

Core CPI

+0.2% MoM (-0.1 pp lower than both consensus and Cleveland) and +3.5% YoY (in line with consensus while it is either in line or -0.1 pp lower than Cleveland Fed as it is unclear whether 3.55% is 3.5% or 3.6%)

My unrounded estimates:

If CPI comes as I expect, this will likely not make the Fed cut rates immediately but it could result with an overall dovish tone of the Fed meeting and Powell’s press conference tomorrow.

If you’re interested in learning more what the Fed will likely do this year, when they may start cutting rates and why consider subscribing to Marko’s Fed Report which is a detailed macroeconomic analysis of the Fed, economy and PCE inflation that, among other things, contains:

A detailed analysis of the economy and which type of landing are we in

An analysis of the monetary policy lags

What will the Fed likely do in the remainder of 2024

PCE inflation (headline and core) trajectory for 2024

To get Marko’s Fed Report, make sure to subscribe to Arkomina Research Pro Investor.

As a subscriber to this article you get a Special Offer of up to -60% off on premium research.

For more information about Arkomina Research and how to subscribe using Special Offer click this link here.

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as a legal, tax, investment, financial or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral or special damages or losses of any kind.

Thank you Marko