Wednesday at 8:30 am ET we will get Oct CPI. In the recent months Fed’s focus has, perhaps, been more on the employment part of their mandate than it was on inflation. However, inflation might have returned more into the limelight after the Fed’s latest meeting. That said Oct CPI could be an extremely important piece of the puzzle in determining what the Fed does in Dec.

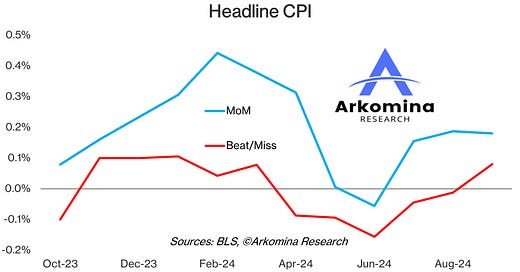

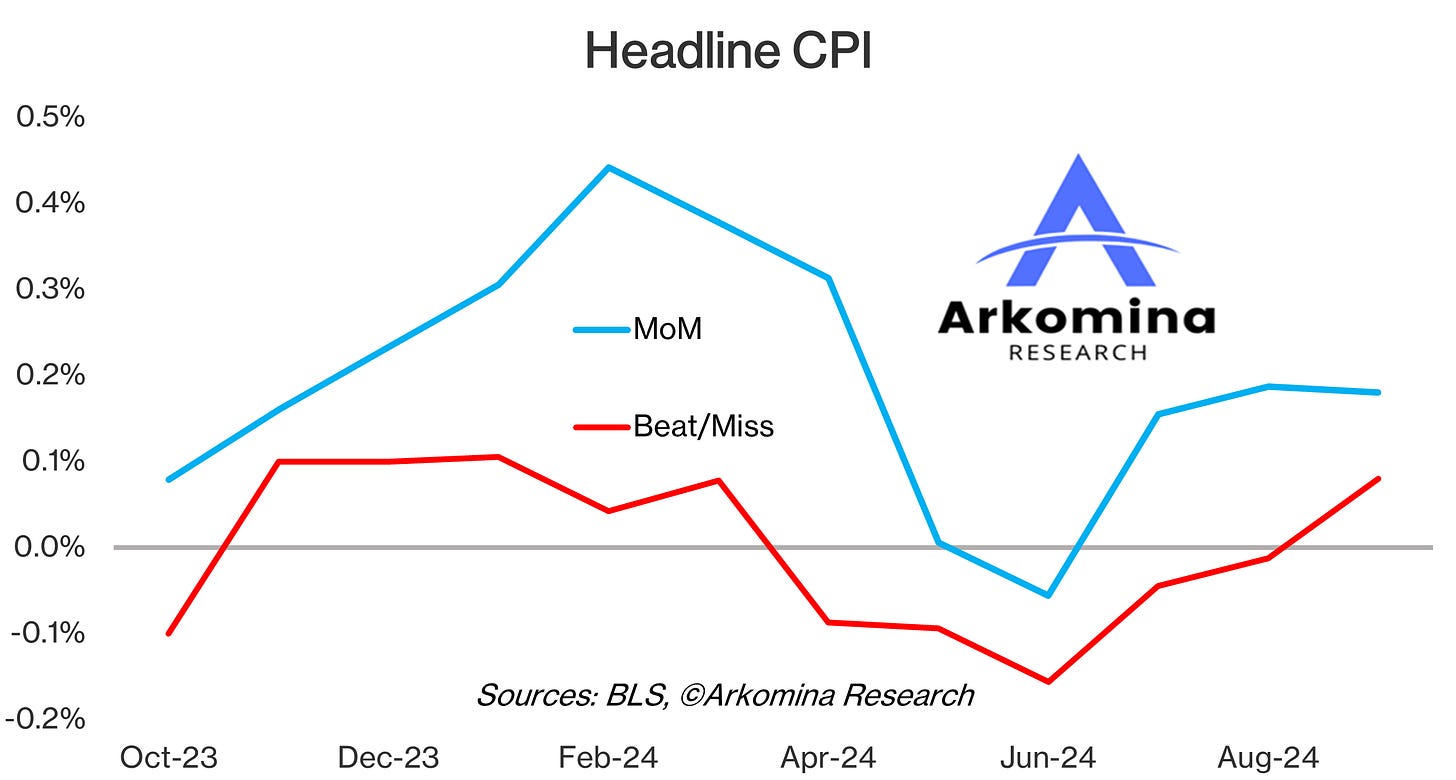

This year CPI figures have been all over the place. First, we had high headline CPI in Q1 (+0.38% MoM on average) coming after much tamer Q4 2023 (+0.16% MoM on average). Then we got extremely cool prints in Q2 (only +0.09% MoM on average), while cool prints also continued in Q3 (+0.17% MoM on average). Unlike Q1 which was higher than desired, headline CPI prints in Q2 and Q3 have been mostly consistent with the Fed’s inflation target, and they mostly came in better than expected (0.1 pp better on average). Still, Sep was +0.1 pp higher than expected.

Core CPI for the most part of 2024 acted similarly to headline, although the last couple of months were a bit higher than expected. Q1 was unusually high (+0.37% MoM on average) coming after tamer Q4 2023 (+0.27% MoM on average). Then Q2 was notably cooler (+0.17% MoM on average), but Q3 went up again (+0.25% MoM on average). Core CPI in Q2 and Q3 came in line with expectations on average, but Aug and Sep were 0.1 pp higher than expected), the first misses since Mar.

My average error for estimating headline CPI (based on last 20 CPI estimates from Feb 2023 - Sep 2024) is extremely low at -2 bps (-0.02 pp).

My average error for estimating core CPI (based on last 20 core CPI estimates from Feb 2023 - Sep 2024) is low -3 bps (-0.03 pp).

For public links to my prior month CPI estimates go to ArkominaResearch.com.

The 2 biggest questions on everyone’s mind are:

Has headline CPI continued to improve from +2.4% YoY in Sep?

Has core CPI stopped going higher after +3.3% YoY in Sep?

The answers to these 2 questions will be crucial in shaping up expectations for the Fed meeting in Dec.

My Oct CPI estimates are…

Headline CPI

+0.2% MoM (same as consensus and +2 bps higher than the Cleveland Fed)

+2.6% YoY (barely, same as consensus and -1 bps lower than the Cleveland Fed)

Core CPI

+0.3% MoM (same as consensus and -1 bps lower than the Cleveland Fed)

+3.3% YoY (same as consensus and +1 bps higher than the Cleveland Fed)

My unrounded estimates:

It is unusual to see my estimates in line with consensus and almost perfectly in line with the Cleveland Fed so we will see how this one goes.

To answer the previous 2 questions, I am expecting headline CPI to stop improving and actually go up in Oct (from +2.44% to +2.55%) for the first time since Mar. I am also expecting core CPI to continue going up (from 3.31% to 3.35%), but this increase might be less than in Sep (went up from 3.20% to 3.31%).

If CPI comes in as I expect, this might raise some concerns that inflation progress might be stalling (headline CPI going up while core CPI is not improving) which could, on the margin, take some probability off the Dec rate cut. However, the Fed will need to get additional data before deciding what to do next month, including Nov CPI, Oct PCE and Nov Employment Report.

If you’re interested in learning my longer-term CPI estimates (until Q3 2025), consider subscribing to Marko’s CPI Report which goes out each month before CPI and, among other things, contains analyses of:

Forward looking inflation indicators

Detailed Oct CPI estimate

Headline and core CPI trajectory until the end of Q3 2025

To get Marko’s CPI Report, make sure to subscribe to Arkomina Research Pro Investor at this link: ArkominaResearch.com/Subscriptions/

By subscribing to Pro Investor you also get:

Marko’s Fed report that goes out before each Fed meeting and, among other things, contains a detailed analysis of the economy and what type of landing we are in, an analysis of monetary policy lags, what will the Fed likely do in 2024 and 2025, headline and core PCE inflation trajectory and unemployment rate trajectory

Marko’s Brain Daily that goes out each trading day containing analyses of all relevant macro indicators and events (such as Fed speeches and Fed meetings) prior day, my estimates for all important macro indicators coming out that day and how the market may react to each scenario, as well as my view of the equity and bond market short-term direction, earnings analyses and much more

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as a legal, tax, investment, financial or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral or special damages or losses of any kind.

Thank you Marko.This is what I wait for every month...