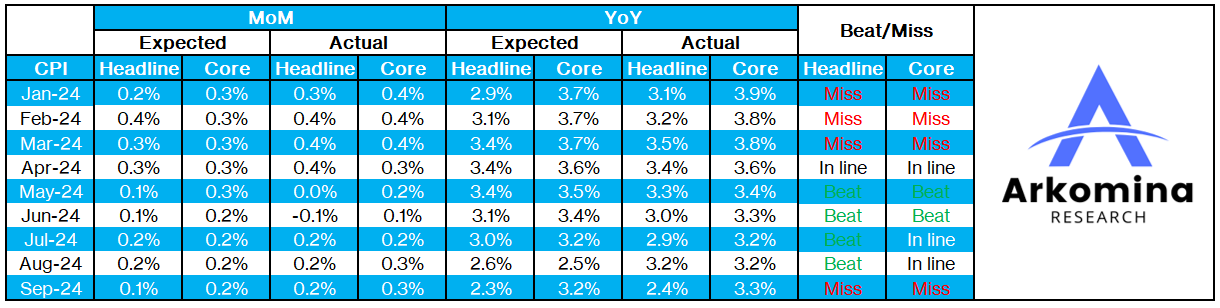

PCE is the Fed’s preferred inflation gauge. After +0.1 pp higher-than-expected CPI in Sep, especially core, fears that inflation might be increasing have gone up. We haven’t had a CPI miss since surprisingly high reads in Q1 this year.

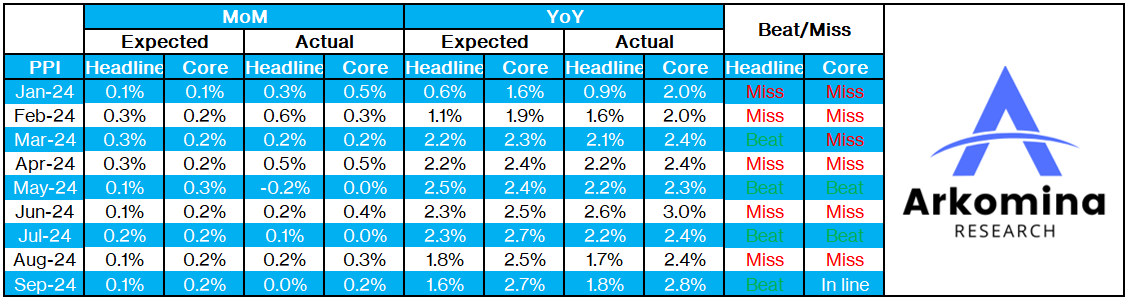

Unlike CPI, PPI was actually better than expected in Sep. PPI was even more volatile YTD than CPI. It managed to fully beat expectations in only 2 of the last 9 months (May and Jul). It also beat expectations for headline PPI (but missed for core) in Mar and Sep (but core was in line).

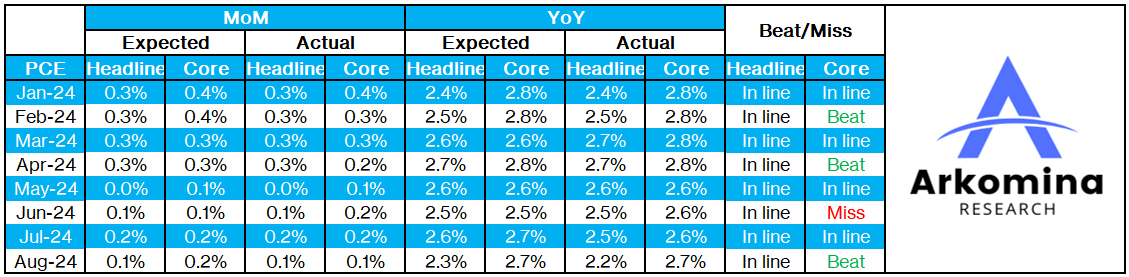

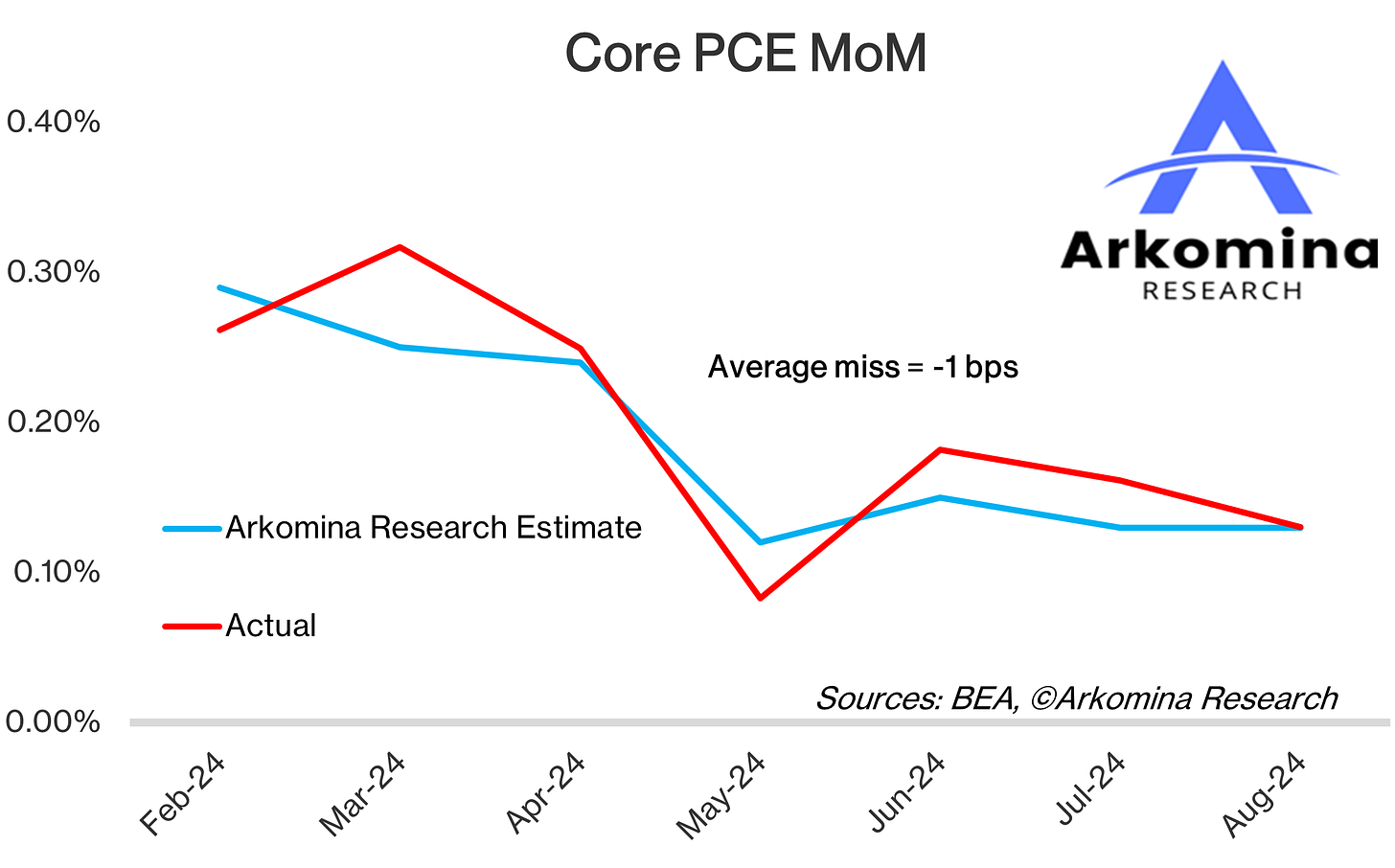

Unlike CPI and PPI which were more volatile and mostly higher than expected in the first months of 2024, PCE mostly came in line with expectations YTD with even 3 beats for core PCE in Feb, Apr and Aug but also one miss for core in Jun.

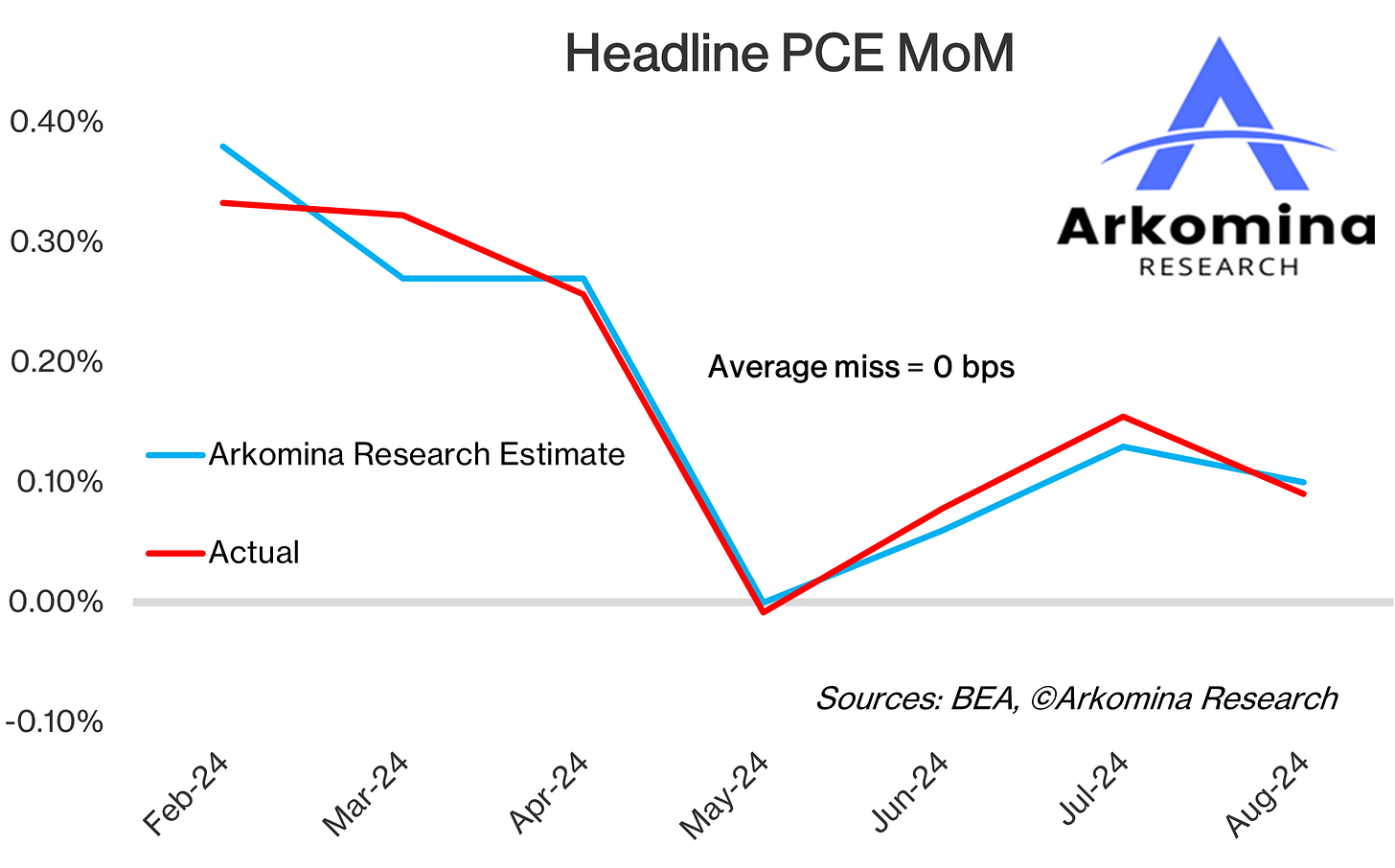

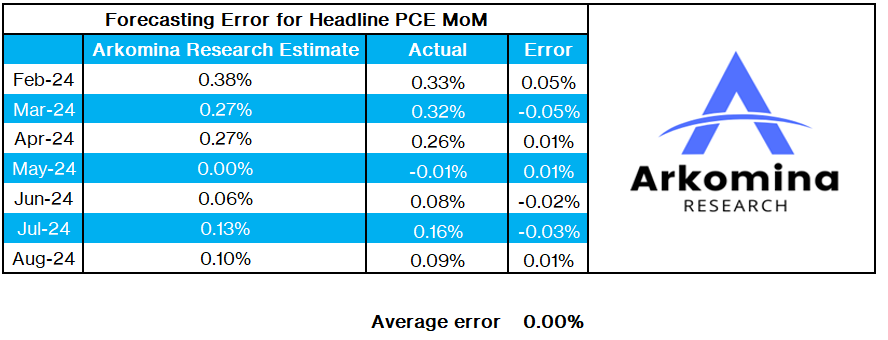

I started publishing my PCE estimates in Mar this year (included PCE forecast for Feb) and so far my estimates have a perfect average error of 0 bps for headline PCE.

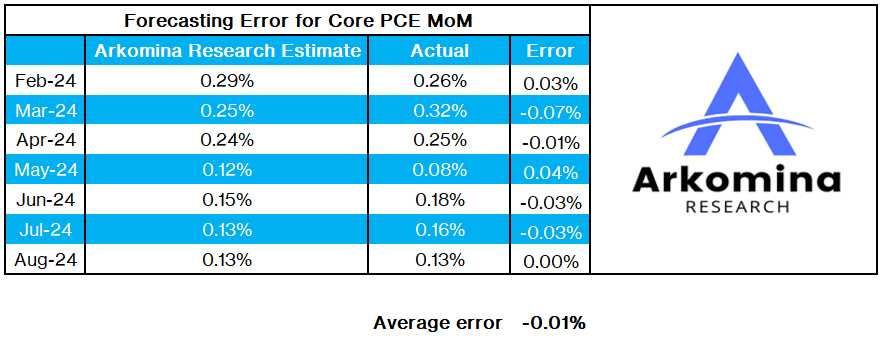

For core PCE, my average error is near perfect, only -1 bps.

Here are links to my prior PCE estimates:

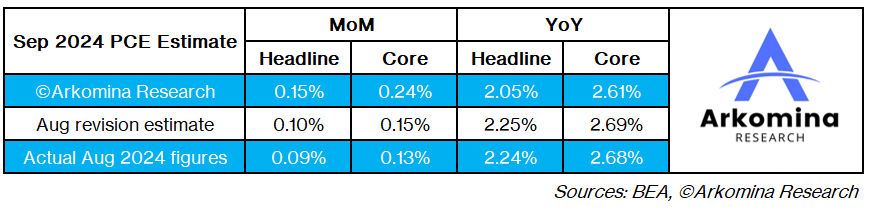

My Sep PCE inflation estimates are…

Headline PCE

+0.1% MoM and +2.0% YoY

Core PCE

+0.2% MoM and +2.6% YoY

My unrounded estimates are:

If my estimates are correct, 2% inflation target might be hit in Sep already. This would be a welcome development after headline PCE remained above target for 3.5 years. That should give more reason to the Fed to continue with rate cuts. At the same time, core PCE may still be +0.6 pp above the Fed’s target which might limit the size of cuts (25 bps seems like the most likely option at this point). That said, the debate around size of cuts in Nov may still not be entirely over, at least not until we get the Oct jobs data.

If you’re interested in learning my longer-term PCE estimates (until mid-2025), consider subscribing to Marko’s Fed Report which goes out before each Fed meeting and, among other things, contains:

Analysis of what the Fed has done so far

Comprehensive analysis of the economy giving the answer to which landing we are in

Analysis of monetary policy lags

PCE forward trajectory (headline and core until the end of Q2 2025)

Unemployment rate forward trajectory (until the end of Q2 2025)

What will the Fed likely do in 2024 and 2025 and why

To get Marko’s Fed Report, make sure to subscribe to Arkomina Research Pro Investor at this link: ArkominaResearch.com/Subscriptions/

By subscribing to Pro Investor you also get:

Marko’s Brain Daily that goes out each trading day containing analyses of all relevant macro indicators and events (such as Fed speeches and Fed meetings) prior day, my estimates for all important macro indicators coming out that day and how the market may react to each scenario, as well as my view of the equity and bond market short-term direction, earnings analyses and much more

Marko’s Fed report that goes out each month before CPI and contains analyses of forward looking inflation indicator, detailed CPI forecast and CPI trajectory until mid-2025

DISCLAIMER

These articles are for discussion and educational purposes only.

Past performance is no guarantee of future results.

Although specific securities and economic forecasts may be discussed in articles, you should NOT construe any comment as a call to buy or sell any security, or as a legal, tax, investment, financial or other advice. Consult your own advisors if you require such advice.

ANY USE OF THESE ARTICLES IS AT YOUR OWN RISK AND LIABILITY. Neither Arkomina Consulting Ltd nor Marko Bjegovic as its director or any employee, accepts any liability whatsoever for any direct, indirect, consequential, moral, incidental, collateral or special damages or losses of any kind.

Thank you